- 25,065

She has 3 more years. (hopefully just 3, lol)

Feeling your pain. Changing majors seems to be a retirement plan. My daughters were the safe drivers. The boys, well.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

She has 3 more years. (hopefully just 3, lol)

I owned and insured my daughter's car until she was 23, graduated college, and moved out to take her first full time job.

but my parents didn't love me as much so they kicked me to the curb and told me to figure it out

In all fairness to your parents, you're really not all that likeable. So, you have see their point, right?

In all fairness to your parents, you're really not all that likeable. So, you have see their point, right?

Full time college student. Home for the summer starting next week. She has 3 more years. (hopefully just 3, lol)

Could you explain the liability issues?

Out of curiosity, would my umbrella policy cover that?

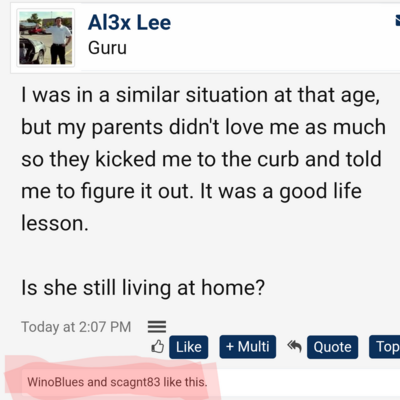

I was in a similar situation at that age, but my parents didn't love me as much so they kicked me to the curb and told me to figure it out. It was a good life lesson.

Is she still living at home?

Here's my advice, based on many years of experience in all three areas:

As long as she is a member of your household, continue to own the car and cover her with your own insurance. You may have to tough it out for a couple of years of surcharges but it's the only way you'll be fully protected from liability lawsuits.

You're at least getting the multi-car discount, and the multi-policy discount if you also have your HO with the same company. That cuts you some slack on the rates.

I owned and insured my daughter's car until she was 23, graduated college, and moved out to take her first full time job. Then I signed the car over to her and she bought her own insurance. There were even a few surcharge years after she rear-ended another car when she was a teenager.