- 10,381

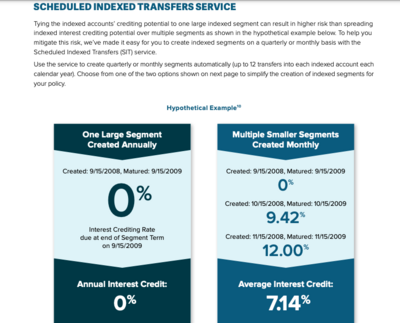

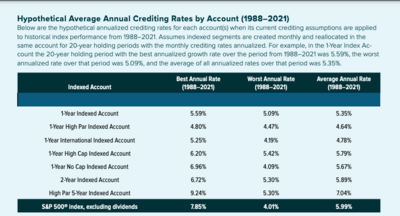

Pac can reduce Caps/Participation/etc. at will and that throws your numbers out the window.

Pac can increase expenses to the max at will. That also throws your numbers out the window.

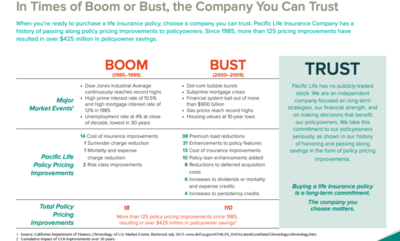

Have you researched Pacs Renewal history?

Do you know the big difference in how Pac assesses Caps and Penn assesses Caps?

Pac can increase expenses to the max at will. That also throws your numbers out the window.

Have you researched Pacs Renewal history?

Do you know the big difference in how Pac assesses Caps and Penn assesses Caps?