- 10,363

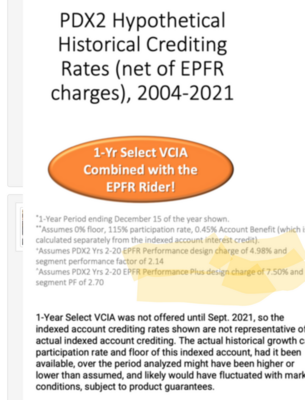

Do those other carriers have a 4.98% or 7.5% design charge.

Honest question, in a flat year on $100k cash value, does this mean a client could would see their following anniversary be at $92,500 because of the 7.5% design charge in addition to whatever the annual COI charges are?

Im not sure what you are speaking of. Are you asking about premium load?

Most IUL products have about 3 or 4 different expense columns. Premium Load, COI, & admin are the usual categories.

Some are now doing an asset charge instead of admin, or dropping the COI in later years and letting the asset charge take over.